SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. )

![[MISSING IMAGE: lg_floordecor-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/lg_floordecor-4c.jpg)

Atlanta, GA 30339

2233 Lake Park DriveSmyrna, GA 30080

March 27, 2018

19, 2024

Company’s common stock in “street name” through a broker, bank or other institution or nominee, you must follow the instructions provided by your broker or other financial institution regarding how to instruct your broker or financial institution to vote your shares.

ONCE A YEAR.

On behalf of the Company, I would like to express our appreciation for your ongoing interest in Floor & Decor Holdings, Inc.

Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2018

11:00 A.M. Eastern Time on Wednesday, May 8, 2024TIME1:00 P.M. Eastern Time on Thursday, May 17, 2018PLACEOmni Hotel at The Battery Atlanta, Glavine Conference Room, Level 2, 2625 Circle 75 Parkway SE, Atlanta, GA 30339ITEMS OF BUSINESS(1)To elect four Class I directors for three-year terms expiring at the 2021 Annual Meeting of Stockholders once their respective successors have been duly elected and qualified or until their earlier resignation or removal (Proposal 1).(2)To ratify the appointment of Ernst & Young LLP as independent auditors for our 2018 fiscal year (Proposal 2).(3)To approve the 2018 Employee Stock Purchase Plan (Proposal 3).(4)To approve, by non-binding vote, the compensation paid to our named executive officers, as disclosed in these proxy materials (commonly known as a "say-on-pay" proposal) (Proposal 4).(5)To recommend, by non-binding vote, the frequency of future advisory votes on executive compensation (commonly known as a "say-on-frequency" proposal) (Proposal 5).(6)To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.RECORD DATEYou are entitled to vote only if you were a stockholder of record at the close of business on March 21, 2018.PROXY VOTINGIt is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to vote online atwww.voteproxy.com. or via telephone by calling 800-776-9437 (800-PROXIES), or to complete and return a proxy card (no postage is required).17, 2018:8, 2024: As permitted by rules adopted by the Securities and Exchange Commission, rather than mailing a full paper set of these proxy materials, we are mailing to many of our stockholders only a notice of internet availability of proxy materials containing instructions on how to access these proxy materials and submitauthorize their respective proxy votes online. This proxy statement, our 20172023 Annual Report on Form 10-K and the proxy card are available atwww.voteproxy.com. You will need your notice of internet availability or proxy card to access these proxy materials.

Executive Vice President, Chief Administrative Officer & Chief Legal Officer

| ||

|

| | ||||||||

| ||||||||

| | | | | | | |||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| ||||||||

Audit Committee Report | | | | | | | ||

| | | | | | | | ||

| | | | | 25 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 49 | | | |

| | | | | | 50 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 56 | | | |

| | | | | | | | ||

| ||||||||

Security Ownership of Certain Beneficial Owners and Management | | | | | | | ||

| ||||||||

| | | | 62 | | | ||

![[MISSING IMAGE: lg_floordecor-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/lg_floordecor-4c.jpg)

Atlanta, GA 30339

2233 Lake Park DriveSmyrna, GA 30080PROXY STATEMENT

The Board of DirectorsStockholders (the "Board"“Annual Meeting”) of Floor & Decor Holdings, Inc., a Delaware corporation (the "Company," "we," "us"“Company,” “we,” “us” or "our"“our”). This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider. Please read the entire proxy statement carefully before voting as it contains important information about matters upon which you are being asked to vote.

| | TIME | | | 11:00 A.M. Eastern Time on Wednesday, May 8, 2024 | |

| | PLACE | | | http://web.lumiagm.com/271307858 | |

| | RECORD DATE | | | You are entitled to vote only if you were a stockholder of record at the close of business on March 13, 2024. | |

| | | | Proposal | | | Board Recommendation | | | See Page | |

| (1) | | | To elect eleven directors for a one-year term expiring at the 2025 Annual Meeting of stockholders once their respective successors have been duly elected and qualified or until their earlier resignation or removal. | | | FOR each Nominee | | | | |

| (2) | | | To ratify the appointment of Ernst & Young LLP as independent auditors for our 2024 fiscal year. | | | FOR | | | | |

| (3) | | | To approve, by non-binding vote, the compensation paid to our named executive officers for the fiscal year ended December 28, 2023, as disclosed in these proxy materials (commonly known as a “say-on-pay” proposal). | | | FOR | | | | |

| (4) | | | To recommend, by non-binding vote, the frequency of future advisory votes on executive compensation (commonly known as a “say-on-frequency” proposal). | | | 1 year | | | | |

| (5) | | | To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof. | | | | | | |

| Name | | | Age | | | Director Since | | | Principal Occupation | | | Committees | |

| Norman Axelrod | | | 71 | | | November 2010 | | | Former CEO, Linens ‘n Things | | | Compensation Committee | |

| William Giles | | | 64 | | | April 2021 | | | Former CFO, AutoZone | | | Audit Committee | |

| Dwight James | | | 50 | | | September 2021 | | | Senior Vice President, Delta Air Lines, Inc. | | | Nominating and Corporate Governance Committee | |

| Melissa Kersey | | | 49 | | | May 2023 | | | EVP & CHRO, Tractor Supply Company | | | Compensation Committee | |

| Ryan Marshall | | | 49 | | | January 2021 | | | CEO, PulteGroup, Inc. | | | Audit Committee | |

| Peter Starrett | | | 76 | | | November 2010 | | | Former President, Warner Bros. Studio Stores Worldwide | | | Compensation Committee | |

| Richard Sullivan | | | 67 | | | April 2017 | | | CEO, PGA TOUR Superstore | | | Audit Committee | |

| Thomas Taylor | | | 58 | | | December 2012 | | | CEO of Floor & Decor Holdings, Inc. | | | None | |

| Felicia Thornton | | | 60 | | | April 2017 | | | Former Interim CEO, 99 Cents Only Stores LLC | | | Nominating and Corporate Governance Committee | |

| George Vincent West | | | 69 | | | 2000 | | | Founder, Floor & Decor | | | None | |

| Charles Young | | | 55 | | | January 2021 | | | President and Chief Operating Officer of Invitation Homes Inc. | | | Nominating and Corporate Governance Committee | |

![[MISSING IMAGE: lg_floordecor-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/lg_floordecor-4c.jpg)

Atlanta, GA 30339

FOUR CLASS IELEVEN DIRECTORS,FOR THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNGEY AS THE INDEPENDENT AUDITORS,FOR THE APPROVAL OF THE 2018 ESPP,FOR THE APPROVAL, ON AN ADVISORY BASIS, OF COMPENSATION PAID TO THEOUR NAMED EXECUTIVE OFFICERS ("SAY-ON-PAY"FOR THE FISCAL YEAR ENDED DECEMBER 28, 2023 (“SAY-ON-PAY”), AND TO RECOMMEND HOLDING THE SAY-ON-PAY VOTEONCE EVERY YEAR ("SAY-ON-FREQUENCY" (“SAY-ON-FREQUENCY”).

Phone. Call 800-776-9437 (800-PROXIES) using any touch-tone telephone to transmit your voting instructions. Have your proxy card in hand when you call.

VotingLLC, Attn: Proxy Tabulation Department, 55 Challenger Rd, Ridgefield Park, NJ 07660.

Beneficial Owners

At

| | | | Proposal | | | Vote Required | |

| 1 | | | The election of eleven directors | | | A “FOR” vote by a majority of votes cast | |

| 2 | | | The ratification of EY as independent auditors for our 2024 fiscal year | | | A “FOR” vote by a majority of votes cast | |

| 3 | | | The Say-On-Pay Proposal | | | A “FOR” vote by a majority of votes cast | |

| 4 | | | The Say-On-Frequency Proposal | | | A “FOR” vote by a majority of votes cast | |

A "FOR" vote by a "majority of votes cast"cast” means that the number of shares voted "FOR"“FOR” exceeds the number of shares voted "AGAINST."

“non-vote?”

“non-vote.”

his or her predecessor; thereafter, any director so appointed will hold office until the next annual meeting of stockholders.

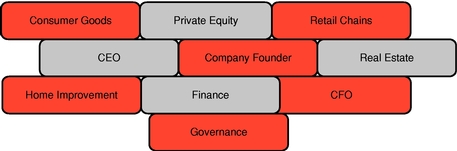

![[MISSING IMAGE: pc_election-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/pc_election-4clr.jpg)

| Skills & Experience | | | Norman Axelrod | | | William Giles | | | Dwight James | | | Melissa Kersey | | | Ryan Marshall | | | Richard Sullivan | | | Peter M. Starrett | | | Thomas Taylor | | | Felicia Thornton | | | George Vincent West | | | Charles Young | | |||||||||||||||||||||||||||||||||

| Audit & Financial Expertise | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | | | |

| Corporate Strategy & Business Development | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | |

| Corporate Governance | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | |

| Ethics/Social Responsibility Oversight | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | |

| Consumer Goods | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | |

| Retail Chains | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | |

| CEO | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | |

| Mergers & Acquisitions | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | |

| Risk Oversight | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | |

| Company Founder | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | |

| Real Estate | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | |

| Home Improvement | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | |

| High Growth | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | |

| Digital/Omni-Channel | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | |

| Human Capital/Compensation Oversight | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | |

| International | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | | | |

| Commercial or B-to-B | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | |

| Years on Board | | | | | 13 | | | | | | 3 | | | | | | 3 | | | | | | 1 | | | | | | 3 | | | | | | 7 | | | | | | 13 | | | | | | 11 | | | | | | 7 | | | | | | 24 | | | | | | 3 | | |

| Demographic Background | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gender | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Male | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | |

| Female | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | |

| Age | | | | | 71 | | | | | | 64 | | | | | | 50 | | | | | | 49 | | | | | | 49 | | | | | | 67 | | | | | | 76 | | | | | | 58 | | | | | | 60 | | | | | | 69 | | | | | | 55 | | |

| Race/Ethnicity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| African American/Black | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | |

| Asian, Hawaiian, or Pacific Islander | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| White/Caucasian | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | |

| Skills & Experience | | | Norman Axelrod | | | William Giles | | | Dwight James | | | Melissa Kersey | | | Ryan Marshall | | | Richard Sullivan | | | Peter M. Starrett | | | Thomas Taylor | | | Felicia Thornton | | | George Vincent West | | | Charles Young | | |||||||||||||||||||||||||||||||||

| Hispanic/Latino | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | |

| Number of Public Boards | | | | | 2 | | | | | | 2 | | | | | | 2 | | | | | | 1 | | | | | | 2 | | | | | | 1 | | | | | | 2 | | | | | | 2 | | | | | | 2 | | | | | | 1 | | | | | | 1 | | |

Brad J. Brutocao, 44,

TableThomas V. Taylor, Jr., 58, has served as our Chief Executive Officer and a member of Contents

our Board since December 2012. Prior to joining us, Mr. Taylor began his career at age 16 in 1983 at a Miami Home Depot store. He worked his way up through various manager, district manager, vice president, president, and senior vice president roles to eventually serve as the Executive Vice President of Operations with responsibility for all 2,200 Home Depot stores and then the Executive Vice President of Merchandising and Marketing, again for all stores. After leaving Home Depot in 2006, for the next six years, Mr. Taylor was a Managing Director at Sun Capital Partners. During his tenure, he was a board member for over twenty portfolio companies in the United States and Europe. Mr. Taylor currently serves on the board of directors of National Vision Holdings Inc., an optical retailer, and Cooper’s Hawk, a differentiated wine club and restaurant concept. Mr. Taylor’s significant experience as a board member and his expertise in the home improvement retail industry led to the conclusion that he should serve as a member of our Board.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTEFOR THE ELECTION OF THE FOUR NOMINEES AS CLASS I DIRECTORS.

Directors Remaining in Office until Our 2019 Annual Meeting of Stockholders

Michael Fung, 67, has served as a member of our Board since April 2017. Mr. Fung was the Interim Chief Operating Officer and Chief Financial Officer for The Neiman Marcus Group LLC, a luxury retailer, from November 2016 through June 2017. Previously, Mr. Fung served as the Interim Chief Financial Officer and Treasurer for 99 Cents Only Stores LLC, a deep-discount retailer, from June to November 2015 and as the Interim Executive Vice President and Chief Administrative Officer from January to September 2013. Mr. Fung served as Senior Vice President and Chief Financial Officer at Walmart U.S., a multinational retailer, from 2006 until his retirement in February 2012, as Senior Vice President, Internal Audit Services from 2003 to 2006, and as Vice President, Finance and Administration of Global Procurement from 2001 to 2003. Before joining Walmart, Mr. Fung spent five years as Vice President and Chief Financial Officer of Sensient Technologies Corporation, a global manufacturer and marketer of colors, flavors and fragrances, preceded by three years as Senior Vice President and Chief Financial Officer of Vanstar Corporation, a developer of information technology and networking solutions and four years as Vice President and Chief Financial Officer of Bass Pro Shops, Inc., a hunting, fishing and outdoor gear retailer. Mr. Fung currently serves as a member of the boards of directors of Franklin Covey Co., a global leader in organizational performance improvement solutions, and 99 Cents Only Stores LLC. Mr. Fung is the immediate past Chair and member of the Board for the Asian and Pacific Islander American Scholarship Fund. Mr. Fung is also a member of the Committee of 100 and the University of Illinois Foundation. Mr. Fung is a Certified Public Accountant (Inactive) in the State of Illinois. He received his B.S. in Accounting from the University of Illinois at Chicago and his M.B.A. from the University of Chicago. Mr. Fung's operating experience at retailers and his service on boards of directors led to the conclusion that he should serve as a member of our Board.

John M. Roth, 59, has served as a member of our Board since November 2010. Mr. Roth joined Freeman Spogli in 1988 and has been a Partner since 1993, he previously served as President and Chief Operating Officer and now serves as Chief Executive Officer. From 1984 to 1988, Mr. Roth was employed by Kidder, Peabody & Co. Incorporated in the Mergers and Acquisitions Group. Mr. Roth has served on the board of directors of El Pollo Loco Holdings, Inc., a differentiated quick service restaurant concept, since December 2007. Mr. Roth previously served on the board of directors of hhgregg, Inc., an electronics and appliances retailer. Mr. Roth received an M.B.A. and a bachelor's degree from the Wharton School of the University of Pennsylvania. With his extensive experience as a board member of numerous retail and consumer businesses and his experience and insights into strategic expansion opportunities, capital markets and capitalization strategies, Mr. Roth is well qualified to serve on our Board.

Thomas V. Taylor, Jr., 52, has served as our Chief Executive Officer and a member of our Board since December 2012. Prior to joining us, Mr. Taylor began his career at age 16 in 1983 at a Miami Home Depot store. He worked his way up through various manager, district manager, vice president, president, and senior vice president roles to eventually serve as the Executive Vice President of Operations with responsibility for all 2,200 Home Depot stores and then the Executive Vice President of Merchandising and Marketing, again for all stores. After leaving Home Depot in 2006, for the next six years, Mr. Taylor was a Managing Director at Sun Capital Partners. During his tenure, he was a board member for over twenty portfolio companies in the United States and Europe. Mr. Taylor's significant experience as a board member and his expertise in the home improvement retail industry led to the conclusion that he should serve as a member of our Board.

Rachel H. Lee, 33, has served as a member of our Board since October 2015. Ms. Lee is a Principal in the Private Equity Group of Ares Management. Prior to joining Ares Management in 2008, Ms. Lee was an investment banking generalist at J.P. Morgan, where she participated in the execution of a variety of transactions including leveraged buyouts, mergers and acquisitions, and debt and equity financings across various industries. She holds a B.S.B.A. from the University of Southern California Marshall School of Business in Corporate Finance and a B.S. from the University of Southern California Leventhal School of Accounting in Accounting. Ms. Lee's experience working with and serving as a director of various companies operating in various industries controlled by private equity sponsors led to the conclusion that she should serve as a member of our Board.

Directors Remaining in Office until Our 2020 Annual Meeting of Stockholders

David B. Kaplan, 50, has served as a member of our Board since October 2010, including as Chairman from October 2010 to December 2011. Mr. Kaplan is a Co-Founder of Ares Management, and a Director and Partner of Ares Management GP LLC, Ares Management's general partner. He is a Partner of Ares Management, Co-Head of its Private Equity Group and a member of its Management Committee. He additionally serves on several of the Investment Committees for certain funds managed by the Private Equity Group. Mr. Kaplan joined Ares Management in 2003 from Shelter Capital Partners, LLC, where he was a Senior Principal from June 2000 to April 2003. From 1991 through 2000, Mr. Kaplan was affiliated with, and a Senior Partner of, Apollo Management, L.P. and its affiliates, during which time he completed multiple private equity investments from origination through exit. Prior to Apollo Management, L.P., Mr. Kaplan was a member of the Investment Banking Department at Donaldson, Lufkin & Jenrette Securities Corp., an investment banking and securities firm. Mr. Kaplan currently serves as Chairman of the board of directors of the parent entities of Neiman Marcus Group, Inc., a luxury retailer, and Smart & Final Stores, Inc., a warehouse-style food and supply retailer, and as a member of the boards of directors of ATD Corporation, a replacement tire distributor, 99 Cents Only Stores LLC, a deep-discount retailer, and the parent entity of Guitar Center, Inc., a musical instruments retailer. Mr. Kaplan's previous public company board of directors experience includes Maidenform Brands, Inc., an intimate apparel retailer, where he served as the company's Chairman, GNC Holdings, Inc., a specialty retailer of health and wellness products, Dominick's Supermarkets, Inc., a grocery store retailer, Stream Global Services, Inc., a business process outsourcing provider, Orchard Supply Hardware Stores Corporation, a home improvement retailer, and Allied Waste Industries Inc., a waste services company. Mr. Kaplan also serves on the board of directors of Cedars-Sinai Medical Center and serves on the President's Advisory Group of the University of Michigan. Mr. Kaplan graduated with High Distinction, Beta Gamma Sigma, from the University of Michigan, School of Business Administration with a B.B.A. concentrating in Finance. Mr. Kaplan's over 25 years of experience managing investments in, and serving on the boards of directors of, companies operating in various industries led to the conclusion that he should serve as a member of our Board.

Peter M. Starrett, 70, has served as a member of our Board since November 2010. In 1998, Mr. Starrett founded Peter Starrett Associates, a retail advisory firm, and currently serves as its President. In connection with his activities at Peter Starrett Associates, Mr. Starrett also provides consulting services to certain Freeman Spogli affiliated entities. From 1990 to 1998, Mr. Starrett served as the President of Warner Bros. Studio Stores Worldwide, a specialty retailer. Previously, he was Chairman and Chief Executive Officer of The Children's Place, a specialty retailer. Prior to that, Mr. Starrett held senior executive positions at both Federated Department Stores and May Department Stores, each a department store retailer. Mr. Starrett is Chairman of the board of directors of Boot Barn, Inc., a specialty apparel and footwear retailer. From May to November of 2012, Mr. Starrett served as Boot Barn, Inc.'s interim Chief Executive Officer. In addition, he is a member of the board of directors of several private companies. Previously, he was also the Chairman of the board of directors of Pacific Sunwear, Inc. and served on the board of directors of hhgregg, Inc., an electronics and appliances retailer. Mr. Starrett received a B.S.B.A. from the University of Denver and an M.B.A. from Harvard Business School. Mr. Starrett's extensive experience as an officer and a director of both public and private companies in the retail industry led to the conclusion that he should serve as a member of our Board.

George Vincent West,, 63, 69, has served on our Board since he founded us in 2000. He served as our Chief Executive Officer from 2000 to 2002, as co-ChiefCo-Chief Executive Officer from 2008 to 2010 and as Chief Executive Officer from 2010 through 2012. Currently, Mr. West serves as the Vice Chairman of our Board, a position that he has held since December 2012. Mr. West began his business career starting a successful retail glassware business in Atlanta. He was eventually recruited to work for his family building materials business, West Building Materials, which operated in five southeastern states, and eventually became its President. Mr. West also developed and sold a multistate billboard company and has developed several real estate projects across the state of Georgia, the most recent being Utana Bluffs, a boutique mountain home community in the north Georgia Mountains. Mr. West’s most recent venture is Mountain & Marsh Hospitality Group, which offers accommodations in the North Georgia Mountains and the Georgia Coast. Mr. West currently

TableCharles Young, 55, has served as a member of Contents

our Board since January 2021. Mr. Young was promoted to President and Chief Operating Officer of Invitation Homes in 2023, after having served as Executive Vice President and Chief Operating Officer from 2017 to 2023. From 2015 until Invitation Homes completed its merger with Starwood Waypoint Homes (“SWH”), Mr. Young served in a number of senior roles with SWH and its predecessor. Earlier in his career, Mr. Young worked for Goldman, Sachs & Co. in its Real Estate Principal Investment Area (Whitehall) and Goldman’s Investment Banking Division, in mergers and acquisitions. He also has prior experience in real estate development and diversity consulting. Before starting his career in real estate and investment banking, Mr. Young spent several years as a professional football player in the National Football League and the World League of American Football. He is a member of the Stanford Board of Trustees and currently serves as a member of the board of directors of Federal Home Loan Bank of Chicago. He was also a founding member of the LEARN Charter School Network. He received his B.A. in Economics from Stanford University and an M.B.A. from Stanford’s Graduate School of Business. Mr. Young’s operating experience, including in a high-growth public company, his experience in mergers and acquisitions and his real estate expertise led to the conclusion that he should serve as a member of our Board.

2023

stockholders. Ten of our directors who served on the Board in Fiscal 2023 attended our 2023 annual meeting of stockholders.

We are deemed a "controlled company" under the rules of the NYSE, and we qualify for, but do not intend to rely on, the "controlled company" exemption to the board of directors and committee composition requirements under the rules of the NYSE. If we were to rely on this exemption, we would be exempt from the requirements that (1) our Board be comprised of a majority of independent directors, (2) we have a nominating and corporate governance committee composed entirely of independent directors, (3) our compensation committee be comprised solely of independent directors and (4) we conduct an annual performance evaluation of the nominating and corporate governance committee and the compensation committee. The "controlled company" exception does not modify the independence requirements for the audit committee, and we intend to comply with the requirements of the Sarbanes-Oxley Act and the rules of the NYSE, which require that our audit committee be composed of at least three members and entirely of independent directors within one year from the date of our initial public offering (our "IPO").

Since we do not intend to rely on the "controlled company" exemption under the rules of the New York Stock Exchange, the Board has taken all actions necessary to comply with such rules, including appointing a majority of independent directors to the Board and establishing certain committees composed entirely of independent directors within the time frames set forth under the rules of the NYSE.

Currently, our leadership structure separates the offices of Chief Executive Officer and Chairman of the Board with Mr. Taylor serving as our Chief Executive Officer and Mr. Axelrod as Chairman of the Board. We believe this is appropriate as it provides Mr. Taylor with the ability to focus on our day-to-day operations while Mr. Axelrod focuses on oversight of our Board.

As discussed in these proxy materials under the heading “Compensation Discussion and Analysis,” in Fiscal 2023, our Compensation Committee engaged Korn Ferry to provide analysis related to the competitiveness of our executive and director compensation programs, periodic reviews of our compensation peer group, the presentation of compensation and governance trends to the Compensation Committee, advice with respect to reporting requirements pursuant to the Pay versus Performance rules released by the Securities and Exchange Commission, as mandated by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), and other mandates as directed by the Compensation Committee.

![[MISSING IMAGE: pc_race-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/pc_race-4c.jpg)

![[MISSING IMAGE: pc_gender-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/pc_gender-4c.jpg)

We are party to an investor rights agreement among us, Ares Corporate Opportunities Fund III, L.P. ("Ares"), a fund affiliated with Ares Management and FS Equity Partners VI, L.P. and FS Affiliates VI, L.P., funds affiliated with Freeman Spogli Management Co., L.P. (collectively "Freeman Spogli" and together with Ares, our "Sponsors") (the "Investor Rights Agreement"). Pursuant to the terms of the Investor Rights Agreement, each Sponsor is entitled to nominate (a) five directors for election to our Board for so long as it holds 40% or more of our outstanding common stock, (b) three directors for election to our Board for so long as it holds 30% or more of our outstanding common stock, (c) two directors for election to our Board for so long as it holds 15% or more of our outstanding common stock and (d) one director for election to our Board for so long as it holds 5% or more of our outstanding common stock. In particular, Ares has nominated Messrs. Axelrod, Kaplan and Starrett and Mses. Lee and Thornton for election to our Board, and Freeman Spogli has nominated Messrs. Brutocao and Roth for election to our Board. Pursuant to the terms of the Investor Rights Agreement, each Sponsor has agreed to vote in favor of the other Sponsor's nominees and for the election of our then-current chief executive officer to our Board, and subject to any applicable securities exchange or equivalent listing requirements, we have agreed to take all necessary and desirable actions to support the election of such director nominees, including soliciting proxies in favor of such nominees, at each annual or special meeting of our stockholders called for the election of directors. The Investor Rights Agreement also provides that the size of our Board may not exceed 12 members unless otherwise agreed by our Sponsors. In addition, subject to certain conditions, the Investor Rights Agreement provides each Sponsor with certain rights with respect to board committee membership, except to the extent that such membership would violate applicable securities laws or stock exchange or stock market rules.

Directors nominated by our Sponsors may be removed with or without cause by the affirmative vote of the Sponsor entitled to nominate such director. In all other cases and at any other time, directors may only be removed for cause by the affirmative vote of at least a majority of the voting power of our common stock. We are required to bear the expenses associated with any transactions contemplated under the Investor Rights Agreement.

Demand

Subject to certain conditions and restrictions contained in the Registration Rights Agreement, our Sponsors are able to require us to use reasonable best efforts to register their common stock under the Securities Act at any time.

Piggyback Registration Rights

In the event of a demand registration or ifIf we propose to register any of our own securities under the Securities Act in a public offering, we will be required to provide notice to the holders of our common stock with registration rights under the Registration Rights Agreement and provide them with the right to include their shares in the registration statement, subject to certain conditions and exceptions contained in the Registration Rights Agreement.

Agreement

agreements, the arrangement was determined by the other members of the Audit Committee to be an ordinary course, arms’ length transaction.

Policies regarding

EY

| | | | Fiscal 2023 | | | Fiscal 2022 | | ||||||

| Audit Fees | | | | $ | 2,388,290 (1) | | | | | $ | 2,057,083(1) | | |

| Audit-related Fees | | | | | — | | | | | | 30,038(2) | | |

| Tax Fees | | | | | 338,786(3) | | | | | | 224,978(3) | | |

| All Other Fees | | | | | — | | | | | | — | | |

| | | | | $ | 2,727,076 | | | | | $ | 2,312,099 | | |

| | Fiscal 2017 | Fiscal 2016 | |||||

|---|---|---|---|---|---|---|---|

Audit Fees | $ | 1,767,171 | (1) | $ | 941,687 | (1) | |

Audit-Related Fees | — | — | |||||

Tax Fees | 137,864 | (2) | 290,610 | (2) | |||

All Other Fees | — | — | |||||

| | | | | | | | |

| $ | 1,905,035 | $ | 1,232,297 | ||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)

(1)- Audit fees include fees and expenses for professional services rendered for the audit of the

Company'sCompany’s annual consolidated financial statements, reviews of quarterly financial statements and related services.AuditAdditionally, audit feesalsoin fiscal 2023 include fees and expensesassociated with securities offeringsfor professional services rendered for the Form S-8 Registration Statement issued in May 2023.

Our

All of the services provided by Ernst & YoungEY described above were approved by our Audit Committee pursuant to our Audit Committee'sCommittee’s pre-approval policies.

APPROVAL OF THE EMPLOYEE STOCK PURCHASE PLAN (PROPOSAL 3)

On February 28, 2018 the Board approved, subject to stockholder approval, the Floor & Decor Holdings, Inc. Employee Stock Purchase Plan. Stockholder approval of the ESPP requires the affirmative vote of a majority of the shares that are present in person or by proxy and entitled to vote on the proposal at the meeting.

The ESPP is intended to encourage and enable employees of the Company and its designated subsidiaries to acquire common stock of the Company, by offering options to buy shares. We believe that employees who participate in the ESPP will have a closer identification with the Company by virtue of their ability as stockholders to participate in the Company's growth and earnings. The ESPP is intended to be an "employee stock purchase plan" within the meaning of Code Section 423 and the provisions of the ESPP will be construed in a manner consistent with the requirements of such section.

Based on the estimated participation usage rate, the Company believes that the 1,500,000 authorized shares will be sufficient to operate the ESPP for approximately five to seven years, depending in part on the future performance of our common stock. We anticipate filing a Registration Statement on Form S-8 with the SEC to register the amount of new shares of our common stock to be included in the aggregate share reserve under the ESPP, effective upon and subject to stockholder approval of the ESPP, as soon as practicable following such stockholders' approval of the ESPP.

The following summary describes the principal provisions of the ESPP. The summary does not purport to be complete and is qualified in its entirety by the full text of the ESPP attached asAnnex A to this proxy statement.

Under the ESPP, as of the effective date, an aggregate of 1,500,000 shares of common stock (subject to certain adjustments to reflect changes in the Company's capitalization) may be purchased from the Issuer by eligible employees that become participants in the ESPP.

To be eligible to participate in an the ESPP, an individual must: (i) be an employee of the Company or a designated subsidiary and (ii) have at least 90 days of continuous service. However, an otherwise-eligible employee will not be eligible if, immediately after the option is granted, the employee will own stock possessing five percent or more of the total combined voting power or value of all classes of stock of the Company or a parent or subsidiary corporation; and, to the extent allowable under Code Section 423, the Compensation Committee may decide not to extend an offering to one or more categories of employees. Approximately 5,500 employees will be eligible to participate in the ESPP.

The term "designated subsidiary" means each existing subsidiary and future U.S. subsidiaries and parents (if any) that are not specifically excluded from participation by the Compensation Committee. A foreign subsidiary or parent will not be a designated subsidiary unless specifically designated by the Compensation Committee.

The ESPP contemplates offering periods during which eligible employees will be allowed to elect payroll deductions (on an after-tax basis) for the purpose of buying shares under the ESPP. Each offering period will be six months, or such other period designated by the Compensation Committee, beginning on January 1 and July 1 or such other dates as designated by the Compensation Committee. Subject to stockholder approval, the first offering period will begin on July 1, 2018.

On the first day of each offering period (the "offer date," generally January 1 and July 1), each participating employee ("participant") will be granted an option to purchase common stock at the end of the offering period (on the "exercise date," generally the next June 30 or December 31), subject to the $25,000 limit described below. No offering period will begin before the ESPP is approved by stockholders. The purchase price per share of the common stock subject to an offering will be determined by the Compensation Committee, but in no event will the price be less than the lesser of: (i) 85% of the fair market value of a share of common stock on the offer date or (ii) 85% of the fair market value of a share of common stock on the exercise date. The Compensation Committee may modify the purchase price (but not below the minimum described above) upon 30 days' notice prior to the commencement of the applicable offering period.

An eligible employee may participate in an offering (i.e., elect to exercise the option) by electing an amount of deductions to be taken from his or her pay (on an after-tax basis). An eligible employee's maximum deductions may be specified by the Compensation Committee. A participant may increase or decrease the rate of his or her payroll deductions twice in a calendar year and may cancel his or her election at any time with respect to any offering period. In the event of cancellation, a participant would receive in cash the balance of the payroll deductions (without interest) then credited to his or her account.

On each exercise date, each participant's accumulated payroll deductions will be used to purchase shares of common stock at the applicable purchase price, subject to the $25,000 limit described below. If all or a portion of the shares cannot reasonably be purchased on such date because of unavailability or any other reason, such purchase will be made as soon as thereafter feasible. A participant is entitled to all rights as a stockholder when the shares are credited to his or her account.

The fair market value of shares purchased under the ESPP by a participant in any calendar year shall not exceed $25,000; no option will give a participant the right to purchase shares with a value in excess of that amount. For this purpose, fair market value of a share is determined as of the offer date for the period when the share was purchased. If a participant's accumulated payroll deductions for a period exceeds the amount required to purchase the maximum number of shares (i.e., shares with the maximum value), any excess accumulated deductions will be returned to the employee.

If, during an offering period, a participant's continuous service terminates for any reason or a participant ceases to be an eligible employee, and the participant does not elect to cancel his or her election, such participant's accumulated payroll deduction amount as of such occurrence will be used on the next exercise date to purchase shares; but if a designated subsidiary is no longer part of the ESPP, the entire payroll deduction amount credited to each participant who is employed by such subsidiary will be refunded. Other rules apply if a participant is granted a leave of absence or is laid off.

The ESPP is administered by the Compensation Committee. The Compensation Committee may delegate its duties and responsibilities under the ESPP, as determined by the Compensation Committee in its sole discretion.

The Board of Directors (or a duly authorized committee thereof) may at any time and for any reason terminate, freeze or amend the ESPP. Except as otherwise described in the ESPP, no amendment or termination may adversely affect any option previously granted. Stockholder approval shall be required for any amendment or termination to the extent (and only to the extent) required by Code Section 423 or any other applicable law, regulation or stock exchange rule.

Neither payroll deductions credited to a participant's account nor any rights with regard to the purchase of or right to receive shares of common stock under the ESPP may be assigned, transferred, pledged or otherwise disposed of in any way (other than by will, the laws of descent and distribution, or as otherwise permitted in the ESPP).

The ESPP is not subject to any of the requirements of ERISA. The ESPP is not, nor is it intended to be, qualified under Code Section 401(a).

Securities Authorized for Issuance Under the 2011 and 2017 Stock Incentive Plans

The following table sets forth information, as of the end of Fiscal 2017, with respect to the FDO Holdings, Inc. Amended and Restated 2011 Stock Incentive Plan (the "2011 Plan") and the Floor & Decor Holdings, Inc. 2017 Stock Incentive Plan (the "2017 Plan"), under which securities are authorized for issuance. See subheadings "2011 Stock Incentive Plan" and "2017 Stock Incentive Plan" in the "Compensation Discussion and Analysis" section below.

Plan Name | Plan Category(1) | Number of securities to be issued upon exercise of outstanding options(3) (a) | Weighted-average exercise price of outstanding options (b) | Number of securities remaining available for future issuance under the equity compensation plans (excluding securities reflected in column (a)) (c) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2011 Plan(2) | Stock options | 9,959,816 | $ | 5.38 | — | |||||||

2017 Plan | Stock options | 1,309,745 | $ | 21.63 | 3,690,255 | |||||||

Total | 11,269,561 | $ | 7.27 | 3,690,255 | ||||||||

TABLE OF CONTENTS

(1)The 2011 Plan and the 2017 Plan are the only equity compensation plans that we have adopted, and each of the 2011 Plan and the 2017 Plan has been approved by our stockholders.(2)No future securities will be issued under the 2011 Plan.(3)The 2017 Plan includes 15,475 shares of restricted stock to certain of our non-employee directors.

Because the actual level of discount and the number of shares purchased under the ESPP will depend on each participant's voluntary election to participate and on the fair market value of the common stock at various future dates, neither the number of shares purchased nor the value to any individual can be determined in advance. On March 26, 2018, the closing price of our common stock on the NYSE was $51.73.

United States Federal Income Tax Consequences

The ESPP is intended to qualify as an "employee stock purchase plan" under Code Section 423. Neither the grant of an option under the ESPP nor the exercise of such option (purchase of common stock) will have any immediate tax consequence for a participant. As of the date of this proxy statement, if a participant disposes of the common stock at least two years after the option was granted to him or her and at least one year after the common stock was purchased, any gain or loss realized upon the disposition of shares will be treated as long-term capital gain or loss to the participant; provided that if the purchase price is less than 100% of the fair market value at the time of purchase (exercise) the participant will realize ordinary income equal to the lesser of: (i) the amount, if any, by which the purchase price was exceeded by the fair market value of the common stock at the time the right to purchase was granted or (ii) the amount, if any, by which the purchase price was exceeded by the fair market value of the common stock on the date of the disposition. No income tax deduction will be allowed to the Company with respect to common stock purchased under the ESPP if such common stock is held for the required periods. If the participant disposes of the common stock before the holding periods described above have been satisfied (i.e., a "disqualifying disposition"), the participant will recognize ordinary income equal to the lesser of: (i) the excess of the fair market value of the common stock at the time of purchase over the purchase price, or (ii) the excess of the fair market value of the common stock at the time of disposition over the purchase price; and any excess gain over such amount will be treated as capital gain. In the case of a disqualifying disposition, the Company will generally be entitled to a deduction in the amount that the participant recognizes as ordinary income.

If a participant dies while holding shares purchased under the ESPP, the participant will realize ordinary income equal to the lesser of: (i) the amount, if any, by which the purchase price was exceeded by the fair market value of the common stock at the time the right to purchase was granted or (ii) the amount, if any, by which the purchase price was exceeded by the fair market value of the common stock on the date of death.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTEFOR THE RATIFICATION OF THE APPROVAL OF THE EMPLOYEE STOCK PURCHASE PLAN.

” 2024. Counsel, until his promotion to Executive Vice President, Chief Administrative Officer & Chief Legal Officer on February 22, 2024; and 2022. at risk and contingent upon the achievement of corporate performance objectives, service requirements and/or share price performance. The components of total target compensation for Fiscal 2023 were: Thomas V. Taylor Trevor S. Lang Lisa G. Laube Brian K. Robbins David V. Christopherson Annual Cash Incentive Bonuses. Our NEOs are eligible to receive annual cash incentives. We consider annual cash incentive bonuses to be Thomas V. Taylor Trevor S. Lang Lisa G. Laube Brian K. Robbins David V. Christopherson rTSR PSUs is determined based on the Company’s average TSR as of the last trading day of the three-year performance period as compared to threshold, target, and maximum levels in relation to the rTSR Peer Group, determined without regard to the Company, as set forth in the table below. If the three-year average TSR for the performance period falls between the percentiles specified in the table, the payout percentages shall be determined on a straight-line interpolated basis. Additionally, the rTSR PSUs will not be eligible to vest above the target number of rTSR PSUs if the Company’s three-year absolute TSR is negative. 401(k) Plan and other certain air travel arising in connection with Mr. Taylor’s regular business-related commuting to and from our corporate office and certain personal travel for Mr. Taylor and/or his family members or other guests. Mr. Taylor’s usage of the Company’s aircraft policy is reviewed by the Compensation Committee on an annual basis. Amounts paid and/or reimbursed under the Company’s aircraft policy constitute taxable income to Mr. Taylor, and we do not gross-up or in any way compensate Mr. Taylor for income tax owed in respect of such amounts. The costs relating to business-related commuting and personal travel by Mr. Taylor and/or his guests are reported as other compensation in the “All Other Compensation” column of the “Summary Compensation Table” below. ” a speculative nature involving our common stock, including, but not limited to, buying or selling puts or calls or other derivative securities based on our common stock. In addition, such persons are prohibited from engaging in short sales of our common stock or entering into hedging or monetization transactions or similar arrangements with respect to our common stock (other than with respect to common stock granted under our employee stock purchase plan). Thomas V. Taylor—Chief Executive Officer Trevor S. Lang—Executive Vice President and Chief Financial Officer Lisa G. Laube—Executive Vice President and Chief Merchandising Officer Brian K. Robbins—Executive Vice President, Business Development Strategy David V. Christopherson—Executive Vice President, Secretary and General Counsel for Fiscal 2023 Thomas V. Taylor Trevor S. Lang Lisa G. Laube Brian K. Robbins David V. Christopherson 2023 Thomas V. Taylor(1) Trevor S. Lang(2) Lisa G. Laube(3) Brian K. Robbins(4) David V. Christopherson(5) 2023 Thomas V. Taylor Trevor S. Lang Lisa G. Laube Brian K. Robbins David V. Christopherson Thomas V. Taylor If Mr. Taylor’s death occurs within the six-month period prior to the next scheduled vesting date of his then outstanding RSUs, the RSUs scheduled to vest on the next vesting date will immediately vest upon Mr. Taylor’s death. Thomas V. Taylor Termination Without Cause/Company Non-Renewal/Resignation for Death/Disability Termination Within One Year Following a Change in Control Trevor S. Lang Lisa G. Laube Brian K. Robbins David V. Christopherson Norman Axelrod (Chairman) Pamela Knous(2) Peter Starrett Vincent West(3) John Roth Brad Brutocao David Kaplan Rachel Lee Michael Fung Felicia D. Thornton Richard L. Sullivan vesting date. 3) Pursuant to our most recent say-on-frequency vote held at our 2018 annual meeting of the stockholders, the Board recommended, and the stockholders approved, that such advisory vote would be conducted every year. ” 3. Named Executive Officers and Directors: Thomas V. Taylor Trevor S. Lang Lisa G. Laube Brian K. Robbins David V. Christopherson Norman H. Axelrod George Vincent West Brad J. Brutocao Michael Fung David B. Kaplan Rachel H. Lee John M. Roth Peter M. Starrett Richard L. Sullivan Felicia D. Thornton All directors and executive officers as a group (15 persons) 5% Stockholders: Ares Corporate Opportunities Fund III, L.P.(13)(14) FS Equity Partners VI, L.P. and FS Affiliates VI, L.P., as a group(13)(15) www.FloorandDecor.comir.FloorandDecor.com. The Board has determined that each of Messrs. Starrett,Giles, Marshall and Sullivan and Fung is independent as independence is defined under the applicable section of the NYSE rules, and that each of Messrs. Starrett,Giles, Marshall and Sullivan and Fung is independent as independence is defined under Rule 10A-3(b)(1) under the Exchange Act. The Board has also determined that each of Messrs. SullivanGiles, Marshall and FungSullivan qualifies as an "audit“audit committee financial expert."Ernst & Young,EY, which includes, among other things, reviewing and evaluating the qualifications, performance and independence of the lead audit partner responsible for our audit, overseeing the required rotation of the lead audit partner and reviewing and considering the selection of the lead audit partner. In appointing Ernst & YoungEY and the lead audit partner, the Audit Committee considered, among other things, the quality and efficiency of the services provided, including the results of a global internal survey of Ernst & Young'sEY’s performance, the technical capabilities of the engagement teams, external data concerning Ernst & Young'sEY’s audit quality and performance obtained from reports of the Public Company Accounting Oversight Board ("PCAOB"(“PCAOB”) and, the engagement teams'teams’ understanding of our company's business.company’s business as well as the potential impact of changing auditors. The Audit Committee and the Board believe that the continued retention of Ernst & YoungEY to serve as the Company'sCompany’s independent auditor is in the best interests of the Company and its stockholders and have recommended that stockholders ratify the appointment of Ernst & YoungEY as the Company'sCompany’s independent auditor for the fiscal year 2018.auditors'auditors’ review of our quarterly financial information with the auditors prior to the release of such information and the filing of our quarterly reports with the SEC. The Audit Committee also met and held discussions with management and Ernst & YoungEY with respect to our audited year-end financial statements.Ernst & YoungEY the matters required to be discussed by Statement on Auditing Standards No. 1301, as amended (Communications With Audit Committees), received the written disclosures and the letter from Ernst & YoungEY required by applicable requirements of the PCAOB regarding the independent registered public accounting firm'sfirm’s communications with the Audit Committee concerning independence, has discussed with the auditors the auditors'auditors’ independence and has considered, among other things, the audit and non-audit services performed by, and the amount of fees paid for such services to, the independent registered public accounting firm. In determining Ernst & Young'sEY’s independence, the Audit Committee considered whether Ernst & Young'sEY’s provision of non-audit services were compatible with the independence of the independent registered public accounting firm. The Audit Committee also discussed with the auditors and our financial management matters related to our internal control over financial reporting. Based on these discussions and the written disclosures received from Ernst & Young,EY, the Audit Committee recommended that the Board include the audited financial statements in the Annual Report for the fiscal year ended December 28, 2017,2023, for filing with the SEC. The Board has approved this recommendation.

William Giles (Chairperson)

Ryan Marshall

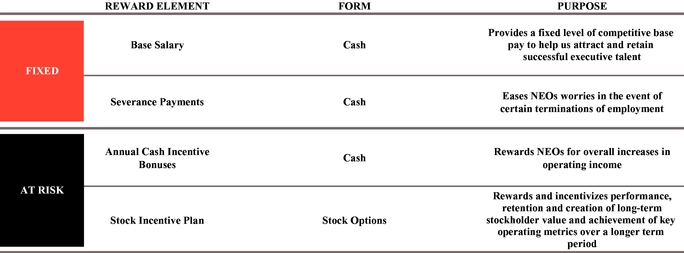

Richard SullivanName Age AUDIT COMMITTEEMichael Fung (Chairperson)Peter M. StarrettRichard L. Sullivan Position NameAgePositionThomas V. Taylor 5258 Chief Executive Officer and a Director Bryan H. Langley 38 Executive Vice President, Chief Financial Officer Trevor S. Lang 4753 Executive Vice President and Chief Financial OfficerLisa G. LaubePresident 55Executive Vice President and Chief Merchandising OfficerBrian K. Robbins60Executive Vice President, Business Development StrategyDavid V. Christopherson 4349 Executive Vice President, Secretary and General CounselChief Administrative Officer & Chief Legal Officer Steven A. Denny 60 Executive Vice President, Store Operations Ersan Sayman 51 Executive Vice President, Merchandising "Election“Election of Four Class IEleven Directors (Proposal 1)—The Nominees."Trevor S. Lang, 47,”Carter's,Carter’s, Inc. since 2003. At Carter's,Carter’s, Mr. Lang was responsible for the management of the corporate accounting and finance functions. From 1999 until joining Carter'sCarter’s in 2003, Mr. Lang served in a progressive series of Vice President roles in the finance area at Blockbuster Inc., culminating in his role as Vice President of Operations Finance where he was responsible for accounting and reporting for over 5,000 company-owned and franchised stores. From 1994 until 1999, Mr. Lang worked in the audit division of Arthur Andersen reaching the level of audit manager. Mr. Lang is a 1993 graduate of Texas A&M University with a B.B.A. in Accounting. He is also a Certified Public Accountant.Lisa G. Laube, 55, has served as our Executive Vice President and Chief Merchandising Officer since 2012. She is responsible for Merchandising, Marketing, Inventory and E-Commerce. From 2005 to 2011, Ms. Laube was President of Party City where she was responsible for Merchandising, Marketing and E-Commerce and prior to that she was the company's Chief Merchandising Officer. From 2002 to 2004, she was the Vice President of Merchandising for White Barn Candle Company, a division of Bath and Body Works. Prior to that, Ms. Laube worked from 1996 to 2002 at Linens 'n Things beginning as a Buyer and progressing to General Merchandising Manager. From 1988 to 1996, she was a Buyer at Macy's in the Textiles division. Ms. Laube began her career at Rich's department store in the Executive Training Program. She graduated from the Terry School of Business, University of Georgia in 1985 with a B.B.A. in Marketing.Brian K. Robbins, 60,Business Development Strategy.Chief Administrative Officer & Chief Legal Officer. He joined the Company as Senior Vice President—Supply Chain in 2013, was promoted to Executive Vice President in 2016 and assumedhas responsibility for our real estate function in 2017Information Technology, Legal, Human Resources, Safety & Loss Prevention, Risk Management and commercial business in 2018. In 2018, his title changed to reflect these additional responsibilities. Prior to joining us, Mr. Robbins was a senior supply chain or merchandising executive with three portfolio companies of Cerberus Capital Management since 2009. He had also held senior supply chain roles with GE and DuPont, and was a Merchandise Vice President with Home Depot. Mr. Robbins currently serves on the board of directors of the parent entity of 99 Cents Only Stores LLC, a deep-discount retailer. Early in his career, Mr. Robbins received his CPA certificate and held various accounting positions with Grant Thornton, Scripps Howard and PricewaterhouseCoopers. Mr. Robbins is a graduate of Miami University with a B.S. degree in Education, majoring in Industrial Management.David V. Christopherson, 43, is our Executive Vice President, General Counsel and Secretary.Sustainability functions. He joined the Company as General Counsel and Secretary in 2013 and was promoted to Senior Vice President in 2015 and Executive Vice President in 2018. In 2024, he was promoted to his current role of Executive Vice President, Chief Administrative Officer & Chief Legal Officer. Mr. Christopherson was the Vice President, General Counsel and Secretary of Teavana Holdings, Inc. from 2011 to 2013 and the Deputy General Counsel of Swett & Crawford from 2007 to 2011. He was previously an attorney with the law firms King & Spalding and Sullivan & Cromwell. Mr. Christopherson received an A.B. in Political Science from Davidson College and a J.D. from Harvard Law School.20172023 to our named executive officers ("NEOs")NEOs listed in the Summary Compensation Table for Fiscal 20172023 that follows this discussion. Our2017, which consist of our principal executive officer, our principal financial officer and our three other most highly compensated executive officers for Fiscal 2017, are:Trevor S. Lang,Lisa G. Laube,Executive Vice President and Chief Merchandising Officer;Brian K. Robbins, who serves as Executive Vice President, Business Development Strategy; and•servesserved as Executive Vice President, Secretary and General Counsel.20172023 Business Performancedriveperform well in Fiscal 2023, despite macroeconomic challenges. Our positive results for our stockholders in Fiscal 2017, asare evidenced by the following:1431 new stores and relocated one store during Fiscal 2017;31.8%3.5% to $1,384.8$4,413.9 million in Fiscal 2017,2023, compared to $1,050.8$4,264.5 million in Fiscal 2016; relatedly, comparable store sales increased 16.6% in Fiscal 2017;operating income increased 70.4% to $117.8 million in Fiscal 2017, compared to $69.1 million in Fiscal 2016, which included a net $10.5 million charge to reserve for a legal settlement; relatedly, operating190160 basis points to 8.5%42.1% in Fiscal 2017; and•net income increased 138.8%2023, compared to $102.8 million40.5% in Fiscal 2017, compared to $43.0 million in Fiscal 2016; relatedly, net income per diluted share was $1.03 in Fiscal 2017 compared to $0.49 in Fiscal 2016.2017,2023, see our Annual Report on Form 10-K for the fiscal year ended December 28, 2017,2023, filed with the SEC on March 5, 2018.February 22, 2024. Core Principles Simplicity and Transparency Base salary, incentive compensation and equity awards should be easy for executives and for our shareholders to understand. Linked to our Strategy Our pay design should create a direct bridge to our strategy, and clearly reflect our key short- and long-term business objectives. Attractive Compensation for Top Talent Pay quantums and design should be compelling enough to attract the best talent we can to support the successful execution of our strategies. Pay for Performance Compensation should be paid only when financial performance levels achieved align with the strategic and financial priorities set by the Board. Appropriate Risk Orientation The more senior a role, the more the total mix of that role’s compensation should be “at risk.” However, our compensation programs are designed in a manner that is intended to provide for performance-based compensation that is both challenging and achievable, and that does not encourage excessive or unnecessary risk-taking. What We Do What We Don'tDon’t Do ✓ XGross-UpsGross-ups: The Company does not provide any excise tax gross-up payments in connection with a change in control✓Annual Compensation Risk Review: Annually assess risk in compensation programslimited perquisites we provide✓Share Ownership Guidelines: NEOs must comply with share ownership requirementsCompany'sCompany’s securities Our Compensation Committee worked with Korn Ferry Hay Group ("Hay Group"), our independent compensation consultant, to develop and formalize our Fiscal 2017 compensation philosophy and to implement compensation arrangements that reflect this philosophy. Our compensation philosophy reflects the following general principles:•Simplicity and transparency: Base salary, bonuses and stock option awards should be easy to understand, and total compensation should be market and performance-based.•Attractive compensation for talent: The more senior the executive, the more pay should be "at risk."•Pay for performance: Compensation should only be paid (with the possibility of no incentive payments) when financial performance is achieved that aligns with the strategic and financial priorities set by the Board.•Operating income is an appropriate measure of performance: Incentive compensation should be tied to operating income because it is a measure of profitability scrutinized by public companies and excludes uncontrollable factors like taxes and interest rates.Determination of Compensation Prior to our IPO, we were privately held, and the Compensation Committee reviewed and recommended the compensation of our NEOs. Following our IPO, the Compensation Committee continues to review and recommend the compensation of our NEOs and will regularly report its compensation decisions and recommendations to our Board. In addition, prior to our IPO, we retained Hay Group to provide advice on compensation for a private company, with such advice being utilized by the Compensation Committee to assist in developing our approach to executive officer and director compensation. In addition to advising our Compensation Committee, Hay Group performed other compensation consulting services for us. Following the IPO, the Compensation Committee has retained Hay Group as its compensation consultant to provide advice on compensation for a public company. In making executive compensation determinations for Fiscal 2017, we relied on the significant experience of our directors in establishing compensation across many companies in multiple industries, as well as the input of our Chief Executive Officer, who has many years of experience in our industry. As a private company, our Compensation Committee analyzed market data for executive compensation focusing on retail companies with $250 million to $1.9 billion in annual revenue. The Compensation Committee also reviewed compensation data from the public filings for the following companies:Big 5 Sporting GoodsConn'sThe Container StoreEthan Allen InteriorsHaverty FurnitureHibbett SportsLa-Z-BoyLumber LiquidatorsRestoration HardwareSelect ComfortTile ShopParty CityPier 1 While the Compensation Committee considered this data from time to time to generally inform decisions relating to NEO compensation, it did not seek to benchmark our NEO compensation to any particular level. The Compensation Committee expects to periodically evaluate competitive market data to include the most suitable peer group as well as other market data deemed relevant. The Compensation Committee will review our NEO compensation against an appropriate peer group on a more formal basis and will also consider other relevant market data to ensure that our NEO compensation is competitive and sufficient to recruit and retain our NEOs. The Compensation Committee expects to periodically review and update this peer group and to utilize Hay Group for benchmarking and peer group analysis in determining and developing compensation packages for our NEOs.2017,2023, our executive compensation program consisted of the following elements:

![[MISSING IMAGE: tb_elements-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/tb_elements-4c.jpg)

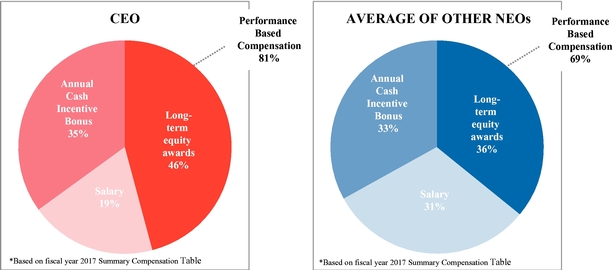

management'smanagement’s interests with our financial performance and with our employees'employees’ and stockholders’ interests. The charts below show the percentageFor Fiscal 2023, approximately 93.4% of our NEOs' 2017current CEO’s target compensation thatand approximately 90.1% on average for our other NEOs, was performance-based.

![[MISSING IMAGE: bc_fiscal-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-035904/bc_fiscal-4clr.jpg)

will continue to evaluate the mix of base salary, short-term incentive compensation and long-term incentive compensation to appropriately align the interests of our NEOs with those of our stockholders. When reviewing each executive'sexecutive’s base salary, the Compensation Committee considers the level of responsibility and complexity of the executive'sexecutive’s role, whether individual performance in the prior year, was particularly strong or weak, and the salaries paid for the same or similar positions in the competitive market. Base salaries for our NEOs as of the end of Fiscal 2016 and 2017 are listed below. At its meeting onIn February 27, 2018,2023, the Compensation Committee and the Board, as applicable, approved salary increases for the NEOs, effective March 2, 2018. TheFebruary 24, 2023, as set forth in the table that follows. Following review of benchmarking analysis against our peer group and in light of increased job duties and responsibilities for certain of our NEOs, the Compensation Committee and the Board, as applicable, determined to increase base salaries of the NEOs by approximately 2.9% to 8.7% after considering the factors listed above.fiscal 2018our NEOs in effect as of the end of Fiscal 2022 and Fiscal 2023 are listed below.Name Fiscal 2022

Base Salary Fiscal 2023

Base Salary Thomas V. Taylor $ 1,030,000 $ 1,060,000 Bryan H. Langley $ 375,000 $ 400,000 Trevor S. Lang $ 575,000 $ 625,000 David V. Christopherson $ 450,000 $ 475,000 Brian K. Robbins $ 450,600 $ 465,000 Fiscal 2016

Base Salary Fiscal 2017

Base Salary Fiscal 2018

Base Salary $ 700,000 $ 850,000 $ 950,000 $ 408,077 $ 422,300 $ 435,000 $ 487,115 $ 490,000 $ 505,000 $ 348,303 $ 360,315 $ 400,000 $ 307,269 $ 321,360 $ 345,000 "at-risk"“at-risk” compensation. As "at-risk"“at-risk” compensation, we increase the size of the target incentive as a percentage of base compensation, proportionate to each executive officer'sNEO’s position and responsibilities. The annual incentives are intended to reward our senior executivesNEOs for achieving a target operating income objectiveand net sales objectives established by the Compensation Committee at the beginning of the year. The maximum annual cash incentive bonus payable pursuant to the 2023 Annual Performance Bonus Program (the “2023 Bonus Program”) is 200% of the NEO’s applicable target bonus.2017, (i) Mr. Taylor was eligible to receive an annual incentive with a target amount equal to 100% of his base salary, (ii) Ms. Laube and Mr. Lang2023 under the 2023 Bonus Program, our NEOs were eligible to receive an annual incentive with a target amount equal to 60%a percentage of their respective full annual base salary (iii) Mr. Robbins was eligible to receive anearned in the fiscal year, as follows:Name Target 2023

Bonus as a %

of Base Salary Target 2023

Bonus ($) Thomas V. Taylor 125% $ 1,325,000 Bryan H. Langley 60% $ 240,000 Trevor S. Lang 70% $ 437,500 David V. Christopherson 65% $ 308,750 Brian K. Robbins 65% $ 302,250 incentive with a target amount equal to 55%incentives for our NEOs were calculated based on achievement of his base salaryFiscal 2023 targeted net sales (20% weighting) and (iv) Mr. Christopherson was eligible to receive an annual incentive with a target amount equal to 50% of his salary. In Fiscal 2017, our target operating income (80% weighting), as determined by the Compensation Committee, calculated as follows:Performance Metric Threshold

($ in millions) Target

($ in millions) Maximum

($ in millions) Weighting

(%) Net Sales $ 4,420.7 $ 4,778.1 $ 5,016.0 20% Operating Income $ 346.6 $ 431.0 $ 479.4 80% annual incentive bonuses was $100.3 million. Our operating income as calculated with respect to such annual cash incentive bonuses was $122.5 million, which was 122% of the target and resulted in a payout percentage of 185%. Operating income was adjusted to reflect one-time costs related to our IPO, hurricanes Harvey and Irma and two secondary offerings of our common stock by certain selling stockholders incurred in 2017. See Note 10 to our consolidated financial statements for Fiscal 2017. Accordingly, basedmetric. Based on our achievement of 122%92.4% of our net sales target and 75.9% of our operating income target for Fiscal 2017, the NEOs received the following annual incentive bonuses: Target Annual

Incentive Target Annual

Incentive % Actual Annual

Incentive Actual Payout

Percentage $ 821,154 100 % $ 1,519,135 185 % $ 251,961 60 % $ 466,127 111 % $ 294,000 60 % $ 543,901 111 % $ 197,244 55 % $ 364,901 102 % $ 159,492 50 % $ 295,059 93 % In February 2018, the Compensation Committee adopted the 2018 Annual Performance Bonus Program (the "2018 Bonus Program"), pursuant to which executive officers, including the NEOs, will be eligible to earn annual cash incentive based upon our achievement of operating income for the 2018 fiscal year. For payouts at target, our operating income must be $144.8 million, with greater payouts possible in the event we exceed our target operating income objective. Under the 2018 Bonus Program, our operating income must be at least $117.7 million in order for any payouts to be made. Mr. Taylor is eligible to receive a bonus with a target amount equal to 100% of his base salary. Ms. Laube and Messrs. Lang, Robbins and Christopherson are each eligible to receive a bonus with a target amount equal to 65%, 65%, 60% and 55% of their respective base salaries.Stock Option Awards.2011 Stock Incentive Plan We maintain the 2011 Plan, pursuant to which, we may grant incentive stock options, non-qualified stock options and restricted stock to our employees, including the NEOs. On September 30, 2016, in connection with a non-recurring extraordinary dividend, we adjusted the exercise price of certain outstanding stock options and made cash payments to certain stock option holders(adjusted in accordance with the terms2023 Bonus Program to reflect the impact of costs such as earn-out liabilities and other transaction costs related to our acquisitions and costs related to employer taxes for stock-based compensation programs), the 2011 Planthresholds for payout under the 2023 Bonus Program were not achieved, resulting in no payout to account for such dividend, including stock options held by the NEOs in order to prevent substantial dilution or enlargement of the rights of such option holders. Certain option holders, including the NEOs, will, in the event of a termination of employment prior to March 31, 2018, be required to repay dividend payments received in respect of stock options that were unvested as of September 30, 2016 and that remain unvested as of the date of termination. There was no incremental change to the fair value of the options in connection with the adjustment of the exercise price. We froze the 2011 Plan in connection with the IPO. No further awards will be granted under the 2011 Plan but awards granted prior to the freeze date will continue in accordance with their terms and the terms of the 2011 Plan.Performance Metric Target

($s in millions) Actual

($s in millions) Percentage of

Target (%) Weighting

(%) Payout

(%) Net Sales $ 4,778.1 $ 4,413.9 92.4% 20% 0.0% Operating Income* $ 431.0 $ 327.1 75.9% 80% 0.0% IPO,2017 initial public offering (“IPO”), our Board adopted and our stockholders approved the Floor & Decor Holdings, Inc. 2017 Stock Incentive Plan, as amended (the “2017 Plan”), pursuant to which we may grant incentive stock options, non-qualified stock options, restricted stock, other stock-based awards and performance-based cash awards to our employees, including the NEOs.NEOs, which may be subject to such service-based, performance-based or other vesting factors or criteria as determined by the Compensation Committee in its discretion in accordance with the 2017 Plan.new omnibus incentive plan was appropriatemix of service-based restricted stock unit awards (RSUs) and performance and service-based performance stock units (PSUs). The Compensation Committee believes that awarding a mix of RSUs and PSUs encourages our NEOs to create and sustain stockholder value over longer periods because their value is directly attributable to changes in connection with a public offeringthe price of our common stock not only to continue to enable us to grant awards to management to rewardover time, and incentivizebecause their full value cannot be realized until vesting occurs, which generally requires continued employment for multiple years and/or achievement of performance and retention, but also to have a long-term equity plan that is appropriate for usgoals. The Compensation Committee views RSUs as a publicly held company. We generally grant stock optionsform of long-term incentive that focuses our NEOs on long-term strategy execution. In addition to the considerations applied to RSUs, the Compensation Committee views the long-term financial metrics applicable to the PSUs, which incorporate both operating profit and balance sheet return on investment performance, as valuable to ensure that our NEOs are appropriately incentivized to create long-term value for the Company and the Company’s stockholders and to effectively allocate capital toward investments that are intended to provide future growth for the Company’s stockholders.connection with their hiringFiscal 2023 is shown below.Name RSUs

Granted (#) PSUs

Granted (#)* Thomas V. Taylor 20,525 20,525 Bryan H. Langley 2,767 2,767 Trevor S. Lang 4,426 4,426 David V. Christopherson 3,873 3,873 Brian K. Robbins 3,043 3,043 waypart of aligning our interests with those of our employees. Under the 2011 Plan, stock options generally become exercisableAnnual Awards vest in equalthree ratable annual installments of 20% each, on each of the first fivethree anniversaries of theirthe grant date, generally subject to the grantee’s continued employment as long as the NEO is continuously employed by us onof each applicable vesting date. For Mr. Taylor, certain stock options become exercisable in annual installments of 25% each on eachThe vesting of the first four anniversariesPSUs granted in Fiscal 2023 as a part of their grant date. In connection with our IPO, we granted optionsAnnual Awards is subject to our eligible employeesachievement of a three-year average ROIC of at least 13.0%, and the achievementApril 26, 2017, including our NEO'sa straight-line interpolated basis. The percentage of the PSUs that becomes vested (if any) will be based on the IPO priceCompensation Committee’s certification of $21.00 per share. These awardsthe Company’s achievement with respect to the performance targets over the three-year performance period. We believe this design most effectively incentivizes our NEOs to drive earnings growth as well as efficiently allocate capital. The Fiscal 2023 PSUs are not expected to meet the threshold requirements for vesting based on performance as of the end of Fiscal 2023. At the end of the performance period in December 2025, the Compensation Committee will vest subjectreview and certify the level of achievement of performance goals with respect to the Fiscal 2023 PSUs, which will be described in our proxy statement for Fiscal 2026.Three-Year Average ROIC Adjusted EBIT Percent of

PSUs Vested Equal to

or greater

than 13.0%

but less than $620,600,000 (Represents CAGR of 12%) 50% Equal to or greater than $620,600,000

but less than $695,200,000 (Represents CAGR of 16%) 100% Equal to or greater than $695,200,000

but less than $765,800,000 (Represents CAGR of 20%) 150% Equal or greater than $765,800,000